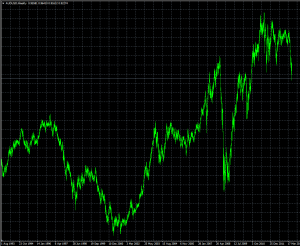

Canadian Dollar Forecast: Outlook Hinges on Inflation Data Following USDCAD

- admin

- 0 comment

- 22.03.2023

Despite recent mixed results, the Canadian Dollar still remains a strong currency. The Bank of Canada has embarked on a tightening cycle and has raised interest rates by 300 basis points since March. Although the BoC has slowed the pace of rate hikes, it is expected to raise rates again in December. This rate hike may help keep the US/Canada currency rate gap from widening. In addition to the BoC, the US Federal Reserve is expected to hike interest rates by 75 bps in November.

As the Fed continues its rate tightening cycle, the Canadian Dollar is expected to be impacted. The Bank of Canada has signaled that it will take the path of least resistance when it comes to monetary policy. While the Fed has a long way to go to reach neutral, the BoC has a relatively easy road ahead of it. The BoC has said it will be able to slow growth without tanking the economy, a statement that has led to a two-month rally in the Loonie.

Inflation has been a driving force for the BoC, with the central bank pointing to it as the most important metric to measure. Several measures have surprised to the upside. The headline inflation number for September was near 7%, while the core inflation number was a bit better at 6.0%. The BoC is expected to raise interest rates again in December, and policy makers are expected to support a 75 bps hike.

The Canadian Dollar has been weighed down by falling oil prices. Oil prices fell to a nine-month low after reports that China may be restricting production. However, prices are rebounding again and this will add to the general risk appetite that has recently returned to global equities markets. The Bank of Canada is forecasting a mild recession in 2023.

The Canadian Dollar’s performance against the Greenback has gotten mixed in recent sessions. The Loonie is expected to weaken in response to the Fed’s rate tightening cycle, and the Bank of Canada’s recent announcement that it may rethink its approach to combating inflation. Inflation figures have proven more persistent than expected, and the BoC will be unhappy to see core inflation rise to a 7% level.

Inflation has also been a driving force in the US, and the Federal Reserve continues to drive the story. The Federal Reserve is expected to announce its third rate hike this year, while the BoC has forecast interest rate hikes in 2022. In addition to the Fed’s rate hikes, the BoC has also forecast the emergence of a mild recession in 2023.

Other factors that have influenced the CAD/USD exchange rate are geopolitics and other monetary policy measures in the US and Canada. Geopolitics is especially important in the post-pandemic global economy. A weaker Chinese economy, coupled with the US economy’s resilience, may boost the Canadian Dollar. In addition, the Bank of Canada is forecasting a mild economic recession in 2023, and its aggressive rate-tightening cycle has put the Canadian economy on track for a recession.